Activities

Divisions

Programs

Activities

Divisions

Programs

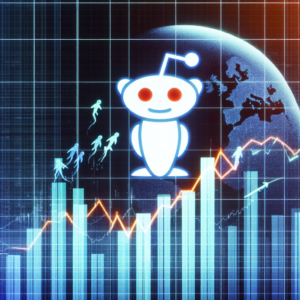

Reddit's Initial Public Offering: Stock value surges by 48% on its first day on the stock market, pushing the company's valuation to $9 billion

Reddit's initial public offering resulted in the company's introduction on the New York Stock Exchange with a valuation exceeding $9 billion. The social networking site's share prices skyrocketed by 48% on its inaugural trading day, escalating from $34 to $50.44 per share.

Reddit's stocks skyrocketed by 48% on its first day of trading on the New York Stock Exchange, ending at $50.44 per share. This increase was seen after Reddit set its share price at $34, close to the upper limit of the expected range, which put the company's worth at more than $9 billion.

The initial public offering, which is among the biggest from a social media platform, put out 22 million shares. In an unusual step, some of these shares were offered to Reddit's users, although it is not known how many were actually taken up.

Established almost 20 years ago, Reddit has grown to be one of the world's most visited websites, with a user base of more than 73 million as of December 2023. Nonetheless, the company's move to go public has sparked renewed debate about its capability to generate revenue from its platform, which mainly supports user-created content and conversations, without charging a subscription fee.

While Reddit has attempted to draw in advertisers with visual improvements in 2017, it has had a difficult time becoming profitable in its initial twenty years. However, a promising solution appears to be emerging, focused on utilizing artificial intelligence (AI) systems. Corporations such as OpenAI are showing interest in paying to use Reddit’s extensive dataset to boost their AI prowess, with Google allegedly paying a hefty sum of $60 million for this access. In addition, Reddit has managed to nail down licensing agreements worth over $200 million for the coming years.

The possibility of making a profit comes with the potential for regulatory oversight and legal issues. Reddit's data licensing practices are currently under investigation by the US Federal Trade Commission (FTC). Moreover, Nokia, a leading mobile phone manufacturer, has charged the platform with patent violation. Reddit's filing with the Securities and Exchange Commission (SEC) also identifies its user base as a possible risk, emphasizing its reliance on content and engagement from users for its business model.

Even though Reddit sometimes faces criticism from its users due to modifications to its platform, and even experienced a shutdown in 2023, it continues to be a major player in the social media world. User dissatisfaction remains, but the lack of a serious rival provides Reddit with a degree of steadiness, allowing its market worth to be linked to its user community.

(Incorporating information from various sources)

Search for us on YouTube

Headline Shows

Connected Stories

Reddit sets sights on a whopping $6.4 billion valuation, hopes to gather a minimum of $500 million

Research uncovers social media algorithms promoting and normalising severe misogynistic content among young individuals

Mark Zuckerberg expresses regret to parents in Senate hearing for putting children at risk

Reddit is gearing up for its IPO, expected to happen by March, and is eyeing a valuation of $10bn

Reddit is setting its sights on a substantial $6.4 billion valuation, with plans to raise at least $500 million

A study reveals that social media algorithms are promoting and making extreme misogynistic content commonplace among the youth

Mark Zuckerberg apologises to parents during a Senate hearing for posing a threat to children

Reddit is preparing for its forthcoming IPO, likely to occur by March, aiming for a valuation of $10bn

can be found on YouTube.

Firstpost holds all permissions and rights, safeguarded by copyright, as of

+ There are no comments

Add yours